Plan your payments smartly with our Online Credit Card Payment Calculator. Estimate monthly payments, interest costs, and payoff timelines with ease. Fast, accurate, and hassle-free!

Credit Card Payment Calculator

Results

| Currency: | |

| Time to Payoff: | |

| Total Interest Paid: | |

| Monthly Payment: | |

| Payoff Date: | |

| Total Paid Amount: |

More Calculator

Heart Rate Calculator Credit Card Payment Calculator

Credit Card Payment Calculator is a useful tool designed to help users manage their credit card debt effectively. With this calculator, you can input your credit card balance, annual interest rate, and payment plans to see how different payment strategies can help you pay off your debt. You can calculate payments based on various timeframes, including monthly amounts or specific periods, all while comparing totals across different currencies. Whether you’re planning to pay off your balance quickly or spread it over time, our calculator helps you visualize your path to financial freedom.

What Are Credit Cards?

Credit cards are financial tools that allow consumers to borrow funds from a pre-approved limit to make purchases or withdraw cash. Unlike debit cards, which draw directly from a bank account, credit cards offer the convenience of deferred payment, allowing users to buy now and pay later. Credit cards are issued by banks or financial institutions and typically come with interest rates, annual fees, and various rewards programs. When a consumer uses a credit card, they are essentially taking out a short-term loan, which they must repay, typically within a monthly billing cycle. Failure to repay the borrowed amount can result in high-interest charges and impact credit scores negatively. In addition to offering convenience, credit cards can also build credit history when used responsibly, making them an essential financial tool for many individuals.

Understanding APR (Annual Percentage Rate)

The Annual Percentage Rate (APR) is a critical factor to consider when using credit cards. It represents the yearly interest charged on borrowed money. For example, if a credit card has an APR of 18%, this means that if you carry a balance of $1,000 for a year, you would owe $180 in interest if you didn’t make any payments. APR can vary significantly among different credit cards, influenced by factors like the cardholder’s creditworthiness, market conditions, and promotional offers. Some cards offer introductory rates lower than the standard APR for a limited period, after which the regular rate applies. Understanding APR is essential for consumers to make informed decisions about credit usage and to avoid excessive interest payments.

Cash Advances and Balance Transfers

Cash Advances: A cash advance allows credit cardholders to withdraw cash using their credit cards, either through an ATM or at a bank. However, cash advances often come with higher interest rates than standard purchases and typically begin accruing interest immediately, without any grace period. Additionally, there are often fees associated with cash advances, making them an expensive way to access cash.

Balance Transfers: Balance transfers enable consumers to move debt from one credit card to another, usually to take advantage of lower interest rates. Many credit cards offer promotional rates for balance transfers, often 0% APR for a specified period. This can significantly reduce interest costs and help pay off debt faster. However, it is crucial to consider transfer fees and the APR that applies once the promotional period ends.

Advantages of Credit Cards

Credit cards come with several advantages that make them a popular choice among consumers:

- Convenience: Credit cards offer a convenient way to make purchases without carrying cash. They are widely accepted by retailers, both online and in-store.

- Rewards Programs: Many credit cards provide rewards such as cash back, travel points, or discounts on future purchases, allowing consumers to earn while they spend.

- Emergency Funds: In emergencies, credit cards can serve as a source of quick funding, helping to cover unexpected expenses without dipping into savings.

- Building Credit History: Responsible use of credit cards can help build a positive credit history, which is essential for future loans, mortgages, or rental applications.

- Purchase Protection: Many credit cards offer purchase protection, allowing consumers to dispute fraudulent charges or receive refunds for defective products.

- Additional Benefits: Credit cards often come with perks such as extended warranties, travel insurance, and access to exclusive events.

These advantages make credit cards an appealing financial tool, but it is essential to use them wisely to avoid falling into debt.

Disadvantages of Credit Cards

Despite their advantages, credit cards also have several disadvantages that consumers should be aware of:

- High-Interest Rates: Credit cards often have higher interest rates compared to other forms of borrowing. If the balance is not paid in full, the accruing interest can lead to significant debt.

- Debt Accumulation: The ease of spending with a credit card can lead to overspending and accumulating debt, making it difficult for consumers to manage their finances.

- Fees: Many credit cards come with annual fees, late payment fees, and cash advance fees, which can add to the overall cost of using credit cards.

- Impact on Credit Score: Mismanagement of credit cards, such as late payments or carrying high balances, can negatively affect credit scores, leading to higher borrowing costs in the future.

- Complex Terms: Credit card agreements often contain complex terms and conditions, making it challenging for consumers to understand the full costs associated with using their cards.

- Impulse Spending: The convenience of credit cards can encourage impulsive buying behavior, leading to financial strain.

Being aware of these disadvantages is crucial for consumers to manage their credit cards effectively and avoid potential pitfalls.

Types of Credit Cards

There are various types of credit cards, each designed for specific needs:

- Standard Credit Cards: These are the most common type of credit card, allowing users to borrow money up to a set limit for purchases and cash advances. They often come with various interest rates and fees, making them suitable for everyday use.

- Rewards Credit Cards: These cards offer rewards, such as cash back or points for every dollar spent. They are ideal for consumers who regularly use their credit cards and want to maximize their spending.

- Secured Credit Cards: Secured cards require a cash deposit that serves as collateral for the credit limit. They are great for individuals looking to build or rebuild their credit history.

- Balance Transfer Credit Cards: These cards are designed for individuals looking to transfer existing credit card debt to take advantage of lower interest rates. They often offer promotional 0% APR for a specified period.

- Travel Credit Cards: Travel cards offer rewards and benefits tailored for travelers, such as airline miles, hotel points, and travel insurance. They are perfect for frequent travelers seeking to earn rewards for their travel expenses.

- Student Credit Cards: These cards are designed for students who are new to credit. They often come with lower credit limits and educational resources to help young adults learn about responsible credit use.

- Business Credit Cards: Business cards cater to small business owners, offering features tailored for business expenses, such as higher credit limits and expense tracking.

Understanding the different types of credit cards can help consumers choose the right card that suits their financial needs.

How to Calculate Interest Charges on Credit Cards

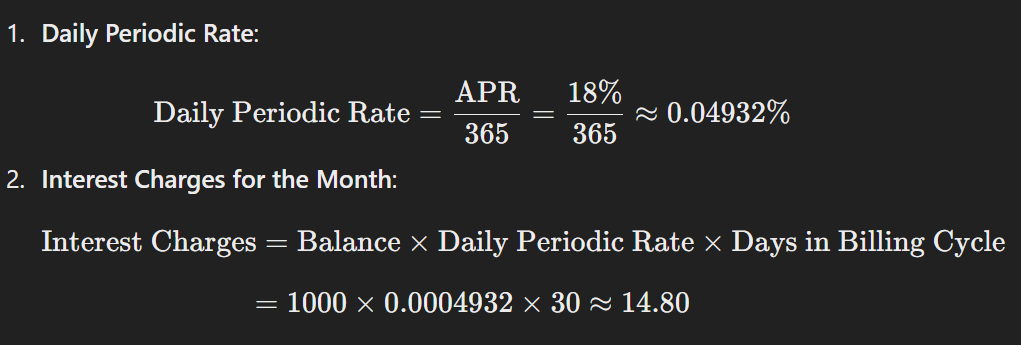

Calculating interest charges on credit cards is essential for understanding how much you will owe if you carry a balance. The formula for calculating interest is relatively straightforward. Here’s a general example using the following details:

- Balance: $1,000

- APR: 18%

- Days in Billing Cycle: 30

Example Calculation:

In this example, you would incur approximately $14.80 in interest charges for that month if you carried a $1,000 balance.

Previous Balance Method

The Previous Balance Method calculates interest based on the balance at the end of the previous billing cycle. This method does not take into account any payments made during the current billing period.

Adjusted Balance Method

The Adjusted Balance Method calculates interest based on the balance at the end of the current billing cycle, accounting for any payments made during that period. This method generally results in lower interest charges because it considers the reduced balance.

Conclusion

The Credit Card Payment Calculator is an invaluable tool for anyone looking to manage their credit card debt effectively. By understanding how credit cards work, including their advantages and disadvantages, consumers can make informed decisions about their financial health. With various types of credit cards available, each serving unique purposes, individuals can select cards that align with their financial goals. Calculating interest charges accurately is crucial in managing credit card debt and avoiding excessive fees. By utilizing our calculator, users can develop effective payment strategies and pave their way to a debt-free future.

FAQs

1. What is the purpose of a Credit Card Payment Calculator?

A Credit Card Payment Calculator helps individuals determine their monthly payments, interest charges, and payoff timelines for credit card debt. It allows users to visualize different payment strategies based on their financial situations.

2. How can I improve my credit score using a credit card?

To improve your credit score, make payments on time, keep your credit utilization low, and avoid accumulating debt. Regularly using and paying off your credit card responsibly builds a positive credit history.

3. What should I consider before getting a credit card?

Before obtaining a credit card, consider factors such as interest rates, annual fees, rewards programs, and your ability to repay any borrowed amounts. Understanding the terms and conditions is vital for responsible credit use.

4. Can I use a credit card for cash advances?

Yes, most credit cards allow cash advances, but be aware of the higher interest rates and fees associated with them. It’s advisable to use this feature sparingly to avoid accumulating debt quickly.

5. What is the difference between APR and APY?

APR (Annual Percentage Rate) is the annual interest rate on borrowed funds, while APY (Annual Percentage Yield) considers compound interest earned on savings. APR is commonly associated with credit cards, while APY is related to savings accounts.