Optimize your trading with our Forex Lot Size Calculator. Calculate the perfect lot size based on risk, account size, and trade setup. Fast, accurate, and easy to use!

Forex Lot Size Calculator

What Are Lots in Forex?

In Forex trading, a lot refers to the smallest tradable unit of a financial asset. The concept of lots is essential in determining the size of a trade and can greatly impact the profit or loss a trader experiences. There are typically three types of lots:

- Standard Lot: This is equivalent to 100,000 units of the base currency. Trading one standard lot means you’re trading 100,000 units. This size is often used by professional traders or those with a substantial capital base due to the larger risk involved.

- Mini Lot: A mini lot is equal to 10,000 units of the base currency. Trading one mini lot is ideal for traders who wish to manage risk better while still participating in significant market movements.

- Micro Lot: A micro lot is equivalent to 1,000 units of the base currency. This is the smallest lot size available and is favored by new traders or those with a smaller account balance, as it allows them to trade with minimal risk.

How Does the Lot Size Calculator Work?

A lot size calculator is a handy tool that helps traders determine the optimal size of their trades based on several factors, including account balance, risk percentage, stop loss, and the current market conditions. Here’s how it works:

- Input Variables: To use the calculator, traders need to input their account balance, the risk percentage they are willing to take per trade, and the stop loss distance in pips.

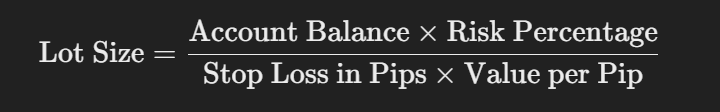

- Calculating Lot Size: The calculator processes these inputs using a specific formula to determine the appropriate lot size. The formula generally used is:

- Result Display: The calculated lot size will then be displayed, allowing traders to make informed decisions on how much of a currency to trade without exceeding their risk tolerance.

What Do You Need to Know for Using a Lot Size Calculator?

Before using a lot size calculator, traders should be familiar with a few essential concepts:

- Account Balance: This is the total amount of funds available in a trading account. It’s crucial for determining how much capital is at risk in a trade.

- Risk Percentage: Traders should have a clear understanding of their risk appetite. This percentage represents how much of the account balance they are willing to risk on a single trade, usually ranging from 1% to 3%.

- Stop Loss: This is a predetermined price level at which a trader will exit a losing trade to prevent further losses. Understanding how to set a stop loss effectively can significantly impact the lot size calculation.

Is It Reliable?

Lot size calculators are reliable tools when used correctly. They help traders manage their risk by calculating appropriate trade sizes based on their unique circumstances. However, traders must ensure they input accurate information and understand that market conditions can change rapidly. Therefore, regular adjustments and considerations of market volatility are essential for maintaining effective risk management.

trading:

Lot Sizes, Charts and Patterns in Forex Trading

| Concept | Description |

|---|---|

| Lot Sizes | |

| Standard Lot | Represents 100,000 units of the base currency. Often used by experienced traders for larger positions. |

| Mini Lot | Equivalent to 10,000 units of the base currency. Suitable for traders looking to balance risk and reward. |

| Micro Lot | Represents 1,000 units of the base currency. Ideal for beginners or those with smaller account balances. |

| Patterns | Description |

|---|---|

| Head and Shoulders | A reversal pattern that signals a change in trend direction. Characterized by three peaks: a higher peak (head) between two lower peaks (shoulders). |

| Double Top/Bottom | Reversal patterns that indicate potential trend reversals. A double top occurs after an uptrend, while a double bottom appears after a downtrend. |

| Flags and Pennants | Continuation patterns indicating that the price will continue in the same direction after a brief pause. Flags are rectangular, while pennants are triangular. |

| Units | Description |

|---|---|

| Account Balance | The total funds available in a trading account, critical for determining how much can be risked per trade. |

| Risk Percentage | The portion of the account balance that a trader is willing to risk on a single trade, typically between 1% and 3%. |

| Stop Loss Level | A predetermined price at which a trader exits a losing trade to limit losses. Important for managing risk effectively. |

| Levels | Description |

|---|---|

| Entry Level | The price at which a trader opens a position. It’s essential to determine the potential profit or loss based on this level. |

| Stop Loss Level | The price at which a trader will exit a trade to prevent further losses, usually set based on market volatility. |

| Take Profit Level | The target price at which a trader will close a profitable trade to secure gains. Critical for implementing a trading strategy. |

Conclusion

In conclusion, understanding lot sizes and how to use a lot size calculator is essential for successful Forex trading. These tools enable traders to manage their risks effectively, ensure they trade with the right size, and enhance their chances of achieving profitable outcomes. By incorporating the proper calculations and techniques, traders can navigate the Forex market with confidence and precision.

FAQs

1. What is a Lot Size Calculator in Forex?

A Lot Size Calculator is a tool that helps traders determine the appropriate lot size to trade based on their account balance, risk percentage, and stop-loss levels. By inputting these variables, traders can calculate how many lots to trade, minimizing their risk exposure while maximizing potential returns. It ensures that trades align with their risk management strategy, promoting responsible trading practices. This calculator is crucial for both novice and experienced traders to maintain discipline in their trading approach.

2. How do I calculate lot size using the calculator?

To calculate the lot size, the calculator requires several inputs: your account balance, risk percentage, and stop-loss distance in pips. The formula typically used is:

By entering these values, the calculator computes the ideal lot size to ensure you don’t risk more than the specified percentage of your account on any trade. This helps in managing risk effectively and allows for better trading decisions.

3. Why is lot size important in Forex trading?

Lot size is critical in Forex trading as it directly impacts the potential profit and loss of a trade. A correctly calculated lot size helps manage risk effectively, ensuring that no more than a predetermined percentage of your account is at risk for each trade. This prevents significant losses that can deplete trading capital. Additionally, understanding lot sizes allows traders to scale their positions according to their strategy, market conditions, and personal risk tolerance, thereby improving overall trading performance.

4. What are the different types of lot sizes in Forex?

In Forex, there are primarily three types of lot sizes: standard, mini, and micro lots. A standard lot is 100,000 units of the base currency, suitable for experienced traders. A mini lot is 10,000 units and provides a balance between risk and reward for those who prefer a smaller scale. A micro lot, representing 1,000 units, is ideal for beginners or those trading with limited capital. Understanding these lot sizes allows traders to choose the right position size based on their account balance and risk appetite.

5. How does leverage affect lot size calculations?

Leverage amplifies both potential profits and losses in Forex trading. When calculating lot size, leverage allows traders to control a larger position than their actual capital would permit. For example, with 1:100 leverage, a trader with a $1,000 account can control a position of $100,000. However, it’s essential to factor in leverage when determining lot size, as higher leverage increases risk exposure. A Lot Size Calculator typically incorporates leverage, helping traders adjust their lot size according to their risk management strategy while considering the increased potential for loss.

6. Can I use a Lot Size Calculator for different trading strategies?

Yes, a Lot Size Calculator can be used for various trading strategies, whether you are a day trader, swing trader, or position trader. Regardless of the strategy, the principles of risk management remain the same. By inputting your account balance, desired risk percentage, and stop-loss levels, the calculator can help determine the appropriate lot size to fit your specific strategy. This ensures that you maintain consistent risk management across different trades, contributing to long-term success.

7. Is a Lot Size Calculator reliable?

Yes, a Lot Size Calculator is reliable as long as the inputs provided by the user are accurate. The calculator uses standard formulas to compute lot sizes based on account balance, risk percentage, and stop-loss levels. However, it’s crucial to understand that while the calculator can assist in making informed trading decisions, it doesn’t guarantee profits. Market conditions can change rapidly, and external factors can impact trades. Therefore, using the calculator as part of a broader trading strategy and risk management plan is essential.

8. What should I know before using a Lot Size Calculator?

Before using a Lot Size Calculator, traders should be familiar with their account balance, the amount of capital they are willing to risk, and the specific market conditions. Additionally, understanding how pips work and how they impact profit and loss is crucial. Traders should also consider their overall trading strategy and psychological readiness for risk. Being informed about market dynamics and having a solid grasp of risk management principles will enhance the effectiveness of the Lot Size Calculator and contribute to more disciplined trading.

9. How does stop-loss placement affect lot size calculations?

Stop-loss placement significantly affects lot size calculations as it determines the potential loss per trade. A wider stop-loss increases the amount of capital at risk, requiring a smaller lot size to maintain the same risk percentage. Conversely, a tighter stop-loss reduces the risk per trade, allowing for a larger lot size. Therefore, accurately assessing where to place stop-loss orders based on market volatility and technical analysis is essential to ensure that lot size calculations align with the trader’s risk management strategy.

10. Can I customize the parameters used in a Lot Size Calculator?

Many Lot Size Calculators offer customization options to accommodate individual trading preferences. Traders can typically input their account balance, desired risk percentage, stop-loss levels, and leverage. Some advanced calculators even allow users to customize the pip value or contract size based on specific trading scenarios. Customizing these parameters helps tailor the calculator’s output to fit individual trading styles and risk tolerances, making it a versatile tool for effective risk management.