Track the impact of inflation on your finances with our Inflation Calculator. Easily calculate the change in the value of money over time to better plan your financial future.

Inflation Calculator

Calculate future value and inflation growth with ease

More Calculator

Nail Growth Calculator Pregnancy Due Date Calculator

inflation is crucial for both individuals and businesses. An inflation calculator is a powerful tool that helps users estimate the impact of inflation on their financial decisions by using each country’s Consumer Price Index (CPI) data. This tool enables users to analyze inflation rates across multiple countries, making it easier to plan for future expenses, investments, and savings. By inputting specific amounts and selecting different time frames, users can visualize how inflation erodes purchasing power over time, thus facilitating informed financial planning.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. It is typically expressed as an annual percentage. Inflation affects everyone, as it erodes the value of money and can impact savings, investments, and living standards. Central banks, such as the Federal Reserve in the United States, monitor inflation closely and may adjust interest rates to manage it effectively. Understanding inflation is essential for making informed financial decisions, whether for budgeting, investing, or retirement planning.

Hyperinflation

Hyperinflation is an extreme form of inflation, where prices rise uncontrollably, often exceeding 50% per month. It typically occurs when there is a significant increase in the money supply without a corresponding growth in economic output. Hyperinflation can devastate economies, leading to the collapse of currencies and the destabilization of entire nations. Historical examples include Germany in the 1920s and Zimbabwe in the late 2000s, where the value of money plummeted, and basic necessities became unaffordable for the average citizen.

Deflation

Deflation is the opposite of inflation and refers to a decrease in the general price level of goods and services. It occurs when the inflation rate falls below 0%, leading to an increase in the purchasing power of money. Deflation can result from reduced consumer demand, overproduction, or increased productivity. While it may sound beneficial, deflation can lead to economic stagnation as consumers delay purchases in anticipation of lower prices, potentially resulting in a downward economic spiral. Central banks often combat deflation by implementing monetary policies aimed at stimulating spending and investment.

How Do Countries Figure Out Their Inflation?

Countries determine their inflation rates primarily through the calculation of the Consumer Price Index (CPI). The CPI measures the average change over time in the prices paid by consumers for a basket of goods and services. This basket typically includes categories such as food, clothing, transportation, healthcare, and housing.

- Data Collection: National statistical agencies collect price data from various sources, including retail outlets, service providers, and online platforms. The prices are collected on a regular basis, often monthly, to track changes accurately.

- Weighting: Each item in the CPI basket is assigned a weight based on its relative importance in the average consumer’s spending habits. For example, housing may have a higher weight than entertainment because it constitutes a larger portion of consumer expenditures.

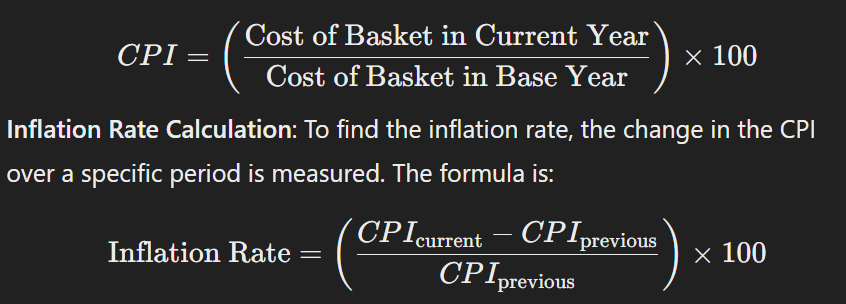

- Index Calculation: The CPI is calculated by taking the price of the current basket of goods and comparing it to the price of the basket in a base year. The formula is:CPI=(Cost of Basket in Current YearCost of Basket in Base Year)×100CPI = \left( \frac{\text{Cost of Basket in Current Year}}{\text{Cost of Basket in Base Year}} \right) \times 100

- Inflation Rate Calculation: To find the inflation rate, the change in the CPI over a specific period is measured. The formula is:

- Adjustments and Variations: Different countries may also consider variations like Core Inflation, which excludes volatile items such as food and energy, to provide a clearer picture of underlying inflation trends.

- Regional Analysis: Countries may break down inflation rates by region or demographic groups to understand better how inflation affects different segments of the population.

Through these comprehensive methods, countries can assess their inflation rates and adjust monetary policies accordingly to stabilize their economies.

Why Inflation Occurs?

Inflation occurs due to various factors, including demand-pull inflation, cost-push inflation, and built-in inflation.

- Demand-Pull Inflation: This type occurs when consumer demand exceeds supply. When more money chases fewer goods, prices rise. For instance, during economic booms, increased consumer spending can lead to higher prices, especially if production cannot keep up with demand.

- Cost-Push Inflation: This occurs when the costs of production increase, prompting businesses to pass on these costs to consumers in the form of higher prices. Factors contributing to cost-push inflation include rising wages, increased prices for raw materials, and supply chain disruptions.

- Built-In Inflation: This type is driven by adaptive expectations. Workers demand higher wages as they expect prices to rise, leading businesses to increase prices to cover higher wage costs. This cycle can perpetuate inflation over time.

- Monetary Policy: Central banks influence inflation through monetary policy. When they increase the money supply, it can lead to inflation. Conversely, tightening the money supply can reduce inflationary pressures.

- Fiscal Policy: Government spending and taxation policies can also affect inflation. Increased government spending can stimulate demand, leading to higher prices if the economy is near full capacity.

- Global Factors: Inflation can also be influenced by global events, such as oil price shocks, trade disputes, and geopolitical tensions, affecting supply chains and production costs worldwide.

Understanding these factors can help individuals and policymakers devise strategies to mitigate the impacts of inflation.

The Monetarists

Monetarists argue that inflation is primarily caused by changes in the money supply. Led by economist Milton Friedman, this school of thought emphasizes the role of central banks in controlling inflation through monetary policy. According to monetarists, if the money supply grows faster than economic output, inflation will rise. They advocate for a stable growth rate of the money supply, aligning with long-term economic growth to keep inflation in check.

Monetarists believe that inflation can be controlled effectively by adjusting interest rates and managing the money supply. For example, if inflation is high, central banks may increase interest rates to reduce the money supply and curb spending. This approach underscores the significance of monetary policy in maintaining price stability.

However, critics argue that monetarism oversimplifies inflation, ignoring other factors such as supply chain disruptions and fiscal policies. While controlling the money supply is essential, it should be part of a broader economic strategy that considers multiple influences on inflation.

Problems with Measuring Inflation

Measuring inflation is fraught with challenges. One major problem is the selection of goods and services in the CPI basket. As consumer preferences change, maintaining an accurate representation of spending habits becomes difficult. Additionally, the introduction of new products and technological advancements can quickly render older items obsolete, complicating the CPI calculation.

Another issue is the quality adjustment of products. Improvements in product quality may lead to higher prices, but these price increases may not accurately reflect inflation if they are due to enhanced features rather than inflationary pressures. Furthermore, regional differences in price levels can distort national averages, making it challenging to capture the true inflation experience for diverse populations.

Lastly, inflation indices can be influenced by seasonal variations and temporary price shocks, leading to misinterpretations of long-term inflation trends. These complexities highlight the need for careful analysis when using inflation data to make economic decisions.

How to Beat Inflation?

Beating inflation requires proactive financial planning and investment strategies. Here are several effective approaches:

- Invest in Assets: Consider investing in assets that historically outperform inflation, such as real estate, stocks, and commodities. These investments often appreciate over time, potentially offsetting the eroding purchasing power of cash.

- Diversify Your Portfolio: Diversifying your investments across various asset classes can help mitigate risks associated with inflation. A well-balanced portfolio can provide stability and growth, even during inflationary periods.

- Consider Inflation-Linked Securities: Invest in inflation-linked bonds, such as Treasury Inflation-Protected Securities (TIPS) in the U.S., which adjust their principal value based on inflation. This guarantees that your investment keeps pace with rising prices.

- Enhance Your Skills: Improving your skills and knowledge can lead to better job opportunities and increased income potential. Higher wages can help counteract the effects of inflation on your standard of living.

- Minimize Debt: Pay off high-interest debt as quickly as possible. Inflation can make debt more manageable in real terms, but the interest you pay can outpace inflation. Reducing debt helps improve cash flow and financial stability.

- Review and Adjust Your Budget: Regularly reviewing your budget allows you to identify areas where you can cut costs. This proactive approach helps you allocate more resources toward savings and investments.

- Stay Informed: Keep up-to-date with economic trends and forecasts. Understanding the inflationary environment can help you make informed financial decisions and adapt your strategy accordingly.

By taking these steps, individuals can better prepare for and mitigate the impact of inflation on their financial well-being.

Conclusion

An inflation calculator is an invaluable tool for understanding the effects of inflation on purchasing power across various countries. By leveraging CPI data, this tool provides insight into how inflation impacts financial planning, investment strategies, and personal budgeting. Understanding inflation, its causes, and how to combat its effects is essential for individuals and businesses alike. As the economy continues to evolve, staying informed about inflation trends and using tools like the inflation calculator will empower consumers to make better financial decisions and secure their financial futures.

FAQs

1. What is an inflation calculator?

An inflation calculator is a tool that helps users estimate how inflation affects the purchasing power of money over time. By using data like the Consumer Price Index (CPI), it calculates the inflation rate and shows users how prices have changed for various goods and services, aiding in financial planning and investment decisions.

2. How does inflation affect my savings?

Inflation erodes the purchasing power of money, meaning that over time, the same amount of money will buy fewer goods and services. For instance, if inflation is 3% per year, a $100 savings account will effectively have the purchasing power of about $97 the following year. This underscores the importance of investing savings in assets that can outpace inflation.

3. Can I calculate inflation for different countries?

Yes, many inflation calculators allow users to calculate inflation for multiple countries by utilizing the respective CPI data. This feature enables individuals to understand how inflation impacts their finances based on their geographical location and make informed financial decisions accordingly.

4. What are the main causes of inflation?

Inflation can arise from various factors, including demand-pull inflation (when demand exceeds supply), cost-push inflation (when production costs rise), and built-in inflation (when wages increase in anticipation of rising prices). External factors like global economic conditions and monetary policies also play significant roles in determining inflation rates.

5. How often is the CPI updated?

The Consumer Price Index (CPI) is typically updated monthly by national statistical agencies. This regular data collection allows for accurate tracking of price changes across a wide range of goods and services, enabling more timely and relevant inflation calculations.

6. What steps can I take to protect my investments from inflation?

To protect investments from inflation, consider diversifying your portfolio by including assets that historically outpace inflation, such as real estate, stocks, and inflation-linked bonds. Additionally, continuously reviewing your investment strategy and staying informed about economic trends can help mitigate risks associated with inflation.