Maximize your profits with our ROI (Return on Investment) Calculator. Quickly calculate your investment returns and profitability with ease. Accurate, efficient, and simple to use!

ROI (Return on Investment) Calculator

More Calculator

Nail Growth Calculator Pregnancy Due Date Calculator

The ROI (Return on Investment) Calculator is an essential tool for investors, business owners, and financial analysts who want to gauge the profitability of investments in various fields, such as stocks, real estate, cryptocurrencies, and even personal ventures. By providing accurate insights into the returns an investment generates over a specific period, this calculator can help in determining whether a venture is profitable, meets the required Return on Investment (ROI) percentage, or should be reconsidered.

Whether you’re evaluating the potential of a new business, analyzing stock returns, or measuring the success of a personal project, an ROI calculator offers a clear snapshot of profitability. Additionally, this calculator covers metrics like Annualized ROI, which is especially helpful for comparing investments over different timeframes. By understanding key financial indicators such as ROI and Rate of Return (ROR), users can make better investment decisions that align with their goals.

Formula for ROI Calculation

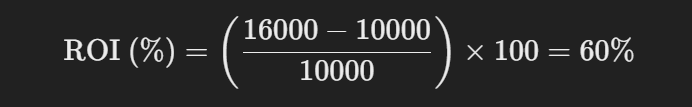

The ROI calculation formula is simple yet powerful:

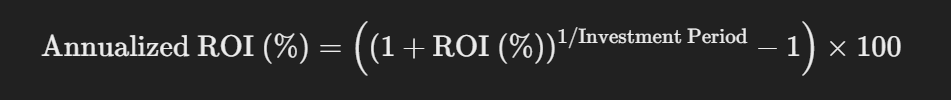

Using this formula, the ROI Calculator determines the percentage gain (or loss) relative to the initial investment. For long-term investments, the Annualized ROI formula offers additional insights by adjusting the ROI to reflect annual returns.

How ROI is Calculated (With Case Study)

Let’s consider an example where an individual invests $10,000 in a startup. After three years, the investment’s value has grown to $16,000. The calculation would be as follows:

- Initial Investment: $10,000

- Final Value: $16,000

- ROI Calculation:

This means that over three years, the investment generated a 60% return. To find the Annualized ROI, we would use the formula:

This yields approximately 16.9% annualized, offering a consistent comparison with other investments.

Difficulty in Usage and Importance of Accuracy

While the ROI formula itself is straightforward, the real challenge lies in accurately estimating the final investment value, especially with volatile assets like stocks or cryptocurrencies. Incorrect projections can lead to misleading ROIs, emphasizing the importance of precise data input. The ROI Calculator simplifies the task, allowing users to focus on gathering accurate investment values for reliable results.

Understanding Annualized ROI and Its Value in Decision-Making

Annualized ROI adjusts a multi-year return to an annual basis, enabling investors to compare multiple investments over varying periods effectively. For example, an ROI of 60% over three years may seem impressive, but when annualized to 16.9%, it provides a more realistic view of annual performance.

Ideal ROI Percentages

In general:

- Above 20%: High returns, especially in the stock market.

- 10-15%: Average returns for many stock and real estate investments.

- Below 10%: Below average but still acceptable for low-risk assets.

In the U.S., business professionals and investors commonly use ROI calculators to keep track of returns and make well-informed investment choices. By tracking their ROI performance, investors can make adjustments to enhance returns or diversify investments if ROI is below expectations.

What to Do if ROI is Below Average?

If your ROI falls below average:

- Review Investment Strategies: Analyze areas where costs could be reduced or profits increased.

- Reallocate Funds: Redirect funds to higher-return assets like stocks or crypto if the risk tolerance allows.

- Consider Compounding Investments: Regularly reinvesting earnings can increase ROI over time.

Some investors find ROI charts helpful to track investments. By examining their returns against typical benchmarks, investors can identify patterns and adjust strategies.

ROI Usage in Different Markets

Stock Market

In stock trading, ROI calculations guide buying and selling decisions based on projected returns. Many traders use Annualized ROI to compare stocks over time, factoring in dividends and capital gains.

Cryptocurrencies

Cryptocurrency investments are highly volatile, making ROI calculations vital. By comparing ROIs across crypto assets, investors can spot trends, identify top-performing coins, and assess long-term viability.

Real Estate

Real estate investments often have longer terms, making ROI crucial for assessing returns after selling property or renting. Annualized ROI enables property investors to compare properties and decide on future investments.

Startups and Small Businesses

For entrepreneurs, ROI is a fundamental metric to gauge the success of business activities. By analyzing returns, small businesses can streamline operations, focus on profitable areas, and track growth.

Conclusion:

An ROI Calculator is a reliable companion for anyone looking to make informed financial choices. By offering clear calculations and insights, it allows users to evaluate investments, compare potential returns, and make data-driven decisions for a prosperous future. Whether you’re an investor, a business owner, or a financial enthusiast, understanding ROI provides a solid foundation for maximizing gains and minimizing losses.

FAQs

1. What is ROI, and why is it important?

- ROI stands for Return on Investment and measures the profitability of an investment. It helps in determining whether an investment is worth pursuing, providing insights into potential gains or losses.

2. How does an ROI Calculator work?

- An ROI Calculator uses the initial investment, final value, and investment period to calculate ROI and, if required, Annualized ROI. This enables a quick evaluation of investment profitability.

3. What is a good ROI percentage?

- A good ROI generally ranges between 10-20%, depending on the asset type. For stocks and real estate, above 15% is considered excellent. For lower-risk assets, 5-10% may be sufficient.

4. Can ROI be negative?

- Yes, a negative ROI indicates that the investment has lost value, suggesting a loss relative to the initial investment.

5. What is the difference between ROI and ROR?

- ROI measures the total return over the entire investment period, while ROR (Rate of Return) can refer to shorter periods, such as annual or monthly returns, and may include compounding.

6. Can I use an ROI calculator for cryptocurrencies?

- Absolutely! An ROI calculator is useful for any asset, including cryptocurrencies. However, due to crypto’s volatility, results can fluctuate frequently.

7. How is Annualized ROI helpful?

- Annualized ROI standardizes returns for different investment periods, making it easier to compare multi-year investments with one-year investments. It’s especially useful in the stock market.

8. What should I do if my ROI is below industry averages?

- Evaluate your investment choices, reduce expenses, or consider reallocating funds. Lower-than-average ROI may suggest a need for adjustments in strategy.